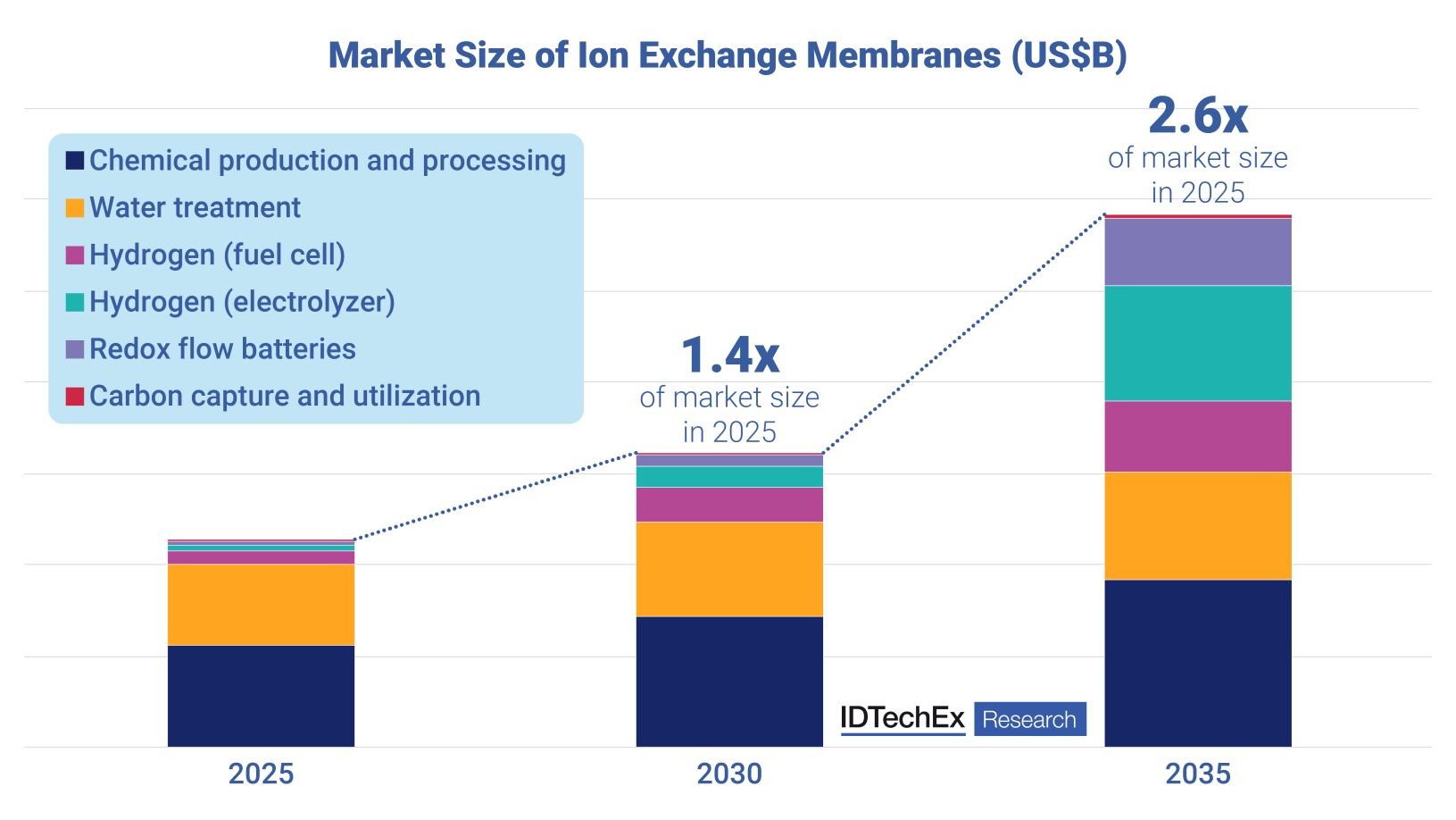

US$2.9B Market Opportunity for Ion Exchange Membranes by 2035

Author: Dr Jack Howley, Technology Analyst at IDTechEx

Ion exchange membrane materials are in an enviable position, having emerged as a critical component in numerous decarbonized transport, energy generation, and storage technologies. Ion exchange membrane materials are electrically conductive speciality polymer films capable of selective ion conduction, typically used as solid electrolytes or separator layers in electrochemical cells. In their new report, “Ion Exchange Membranes 2025-2035: Technologies, Markets, Forecasts“, IDTechEx forecasts that the ion exchange membrane market will exceed US$2.9B in revenue annually by 2035, driven by maturing applications in green hydrogen production, hydrogen fuel cells, and redox flow battery technology.

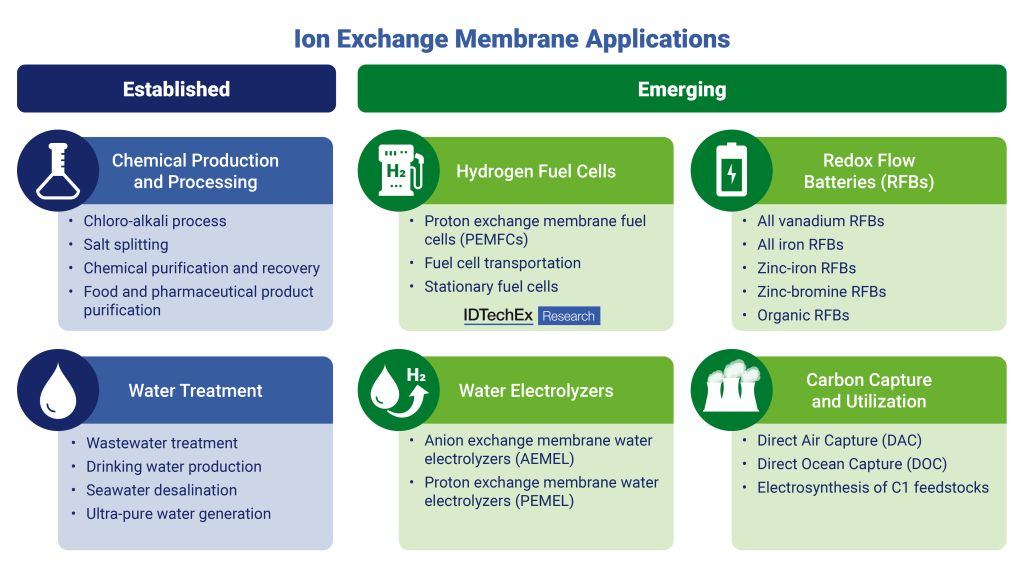

Historically, ion exchange membrane technology has been applied in electrolyzers and electrodialyzers for chemical production and water treatment. In 2025, ion exchange membranes are now key materials in many electrochemical technologies for green hydrogen, stationary energy storage, carbon capture, and utilization. The ion exchange membrane market is poised to transform, with material design, manufacturing innovations, and growing demand in new applications set to shape the market over the next decade.

Ion exchange membrane material options remain diverse, but consolidated

Perfluoroalkyl sulfonate (PFSA) based cation exchange membranes (CEMs) continue to dominate the market, boasting superior chemical and mechanical stability that ensures performance in high-temperature and corrosive applications. In 2025, PFSA ion exchange membranes represent over 85% of global ion exchange membrane demand.

Proton exchange membranes (PEMs), such as Nafion, are incumbent materials for hydrogen fuel cell technology, but to maximize power density and efficiency in transportation applications, further reductions in membrane thickness are necessary. To achieve this, the next generation of reinforced membranes are emerging using multilayer structures (e.g., with PTFE) and composite materials (woven supports). Reinforced membranes provide the mechanical stability necessary to reduce sheet thicknesses to as low as 5-10 um. In fuel cell applications, ultrathin ion exchange membranes are enabling a greater number of cells to be integrated within fuel cell stacks, thus realizing performance gains.

With growing concern and regulatory sights set on PFAS-based membranes (per- and poly-fluoroalkyl substances), there is an increasing opportunity for alternative hydrocarbon ion exchange membranes to disrupt the market. Novel polybenzimidazole (PBI), polyether ether ketone (PEEK), and other polycyclic materials are emerging as PFAS-free ion exchange membrane materials. Hydrocarbon ion exchange membranes have seen significant development activity from start-ups in the last ten years, with many focusing on hydrogen fuel cell, water electrolysis, and redox flow battery applications. IDTechEx's latest report, “Ion Exchange Membranes 2025-2035: Technologies, Markets, Forecasts”, evaluates emerging ion exchange membrane materials, including innovations in composition, composite design, manufacturing, and key target markets.

Sustainability shifts focus for growth in mature ion exchange membrane markets

Chemical production, processing, and water treatment applications are high-volume markets for ion exchange membranes routinely applied in electrodialysis, electrolysis, and deionization. In these mature markets, sustainability is a key trend driving the development of ion exchange membrane technology and their integrated systems.

Ion exchange membranes with low sheet thicknesses are improving the energy efficiency of electrolyzer stacks widely used in chloralkali production (NaOH/Cl2) and other acid/base recovery circuits. IDTechEx also identifies the production of battery-grade lithium hydroxide by salt splitting as a growth market for electrolyzer technology, where ion exchange membrane materials with high pH stability are desirable. Within water treatment, IDTechEx predicts that demand for membranes used in electro-deionization and electro-desalination technologies will steadily increase, as water consumption in semiconductor manufacturing is expected to double by 2035.

Ion exchange membranes are critical, high-value materials in green hydrogen technology

Hydrogen fuel cells and water electrolyzers for green hydrogen production rely on ion exchange membranes to selectively conduct H+ or OH- ions. Having emerged as the material of choice, IDTechEx identifies green hydrogen production and transport applications as the fastest growing markets for ion exchange membrane materials by 2035.

Water electrolysis offers opportunities for both anion exchange membranes (AEMs) and proton exchange membranes (PEMs) in green hydrogen production. PEM electrolyzer (PEMEL) systems are the most commercially mature technology, where PFSA-based PEMs (e.g. Nafion) hold a large market share due to their exceptional ion conductivity and chemical-mechanical stability.

AEM electrolyzer (AEMEL) systems using low-cost catalyst materials represent a promising evolution of electrolyzer technology and, with them, significant growth potential for PFAS-free hydrocarbon membranes. Emerging membrane suppliers are positioning to capitalize on potential PFAS bans by supplying PBI or other polymers membranes containing ammonium functionality for AEMEL system integration. IDTechEx's new report, “Ion Exchange Membranes 2025-2035: Technologies, Markets, Forecasts”, provides extensive analysis of membrane requirements, innovation areas, and design trends in water electrolyzer systems.

On the other end of the value chain, perfluorinated proton exchange membranes are overwhelmingly employed in hydrogen fuel cells due to their high chemical stability, mechanical strength, and ionic conductivity. Key technical innovation areas include reducing membrane thickness towards 10 um and below, which will be key to unlocking greater fuel cell power density necessary for transportation applications. Proton exchange membrane fuel cells (PEMFC) are set to grow in line with an expanding fuel cell electric vehicle (FCEV) market as the hydrogen economy continues to gain traction.

Opportunities for ion exchange membranes in redox flow batteries, carbon capture, and utilization

Decarbonization is driving demand for ion exchange materials in redox flow batteries and carbon capture and utilization technologies. Redox flow batteries (RFBs) are rechargeable devices that provide stationary energy storage solutions for remote, off-grid, and microgrid applications. PFSA cation exchange membranes are typically used to separate electrolyte solutions in commercial vanadium redox flow batteries. Development areas for ion exchange membranes in RFBs focus on reducing their high contribution to overall cell stack cost, which can comprise 30-50% across different chemistries. IDTechEx identifies zinc-based RFBs (e.g., Zn-Br) as a growth market for ion exchange membranes, where the higher cell voltages of zinc RFBs present opportunities to use smaller cell stacks, reducing material requirements and, ultimately, stack costs.

Membrane technologies are increasingly employed for carbon capture and utilization; however, this market remains in a nascent stage. Direct air capture using CO2 electrolyzers and direct ocean capture using (bipolar) electrodialysis represent emerging growth markets for ion exchange membranes. Looking towards carbon utilization, both PFSA and hydrocarbon membranes are increasingly applied in prototype carbon dioxide electrolyzers to produce C1 feedstocks such as methanol and formic acid.

Market outlook

IDTechEx forecasts that the ion exchange membrane will exceed US$2.9B in revenue annually by 2035, driven by growth in decarbonized energy and transport applications. Water electrolyzers for green hydrogen production, hydrogen fuel cells, and redox flow batteries represent key ion exchange membrane growth markets. The “Ion Exchange Membranes 2025-2035: Technologies, Markets, Forecasts” report provides comprehensive analysis of current and emerging ion exchange membrane materials and markets, including chemical production and processing, water treatment, green hydrogen economy, redox flow batteries (RFBs), carbon capture and utilization, and sustainable metals processing. In addition, granular 10-year ion exchange membrane market forecasts, including demand in area (m2), weight (tonnes), and annual revenue forecasts ($M), are presented for perfluorinated and hydrocarbon ion exchange membrane materials.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/IEMs.

For the full portfolio of advanced materials and critical minerals market research available from IDTechEx, please see www.IDTechEx.com/Research/AM.