Author: Dr Jack Howley, Technology Analyst at IDTechEx

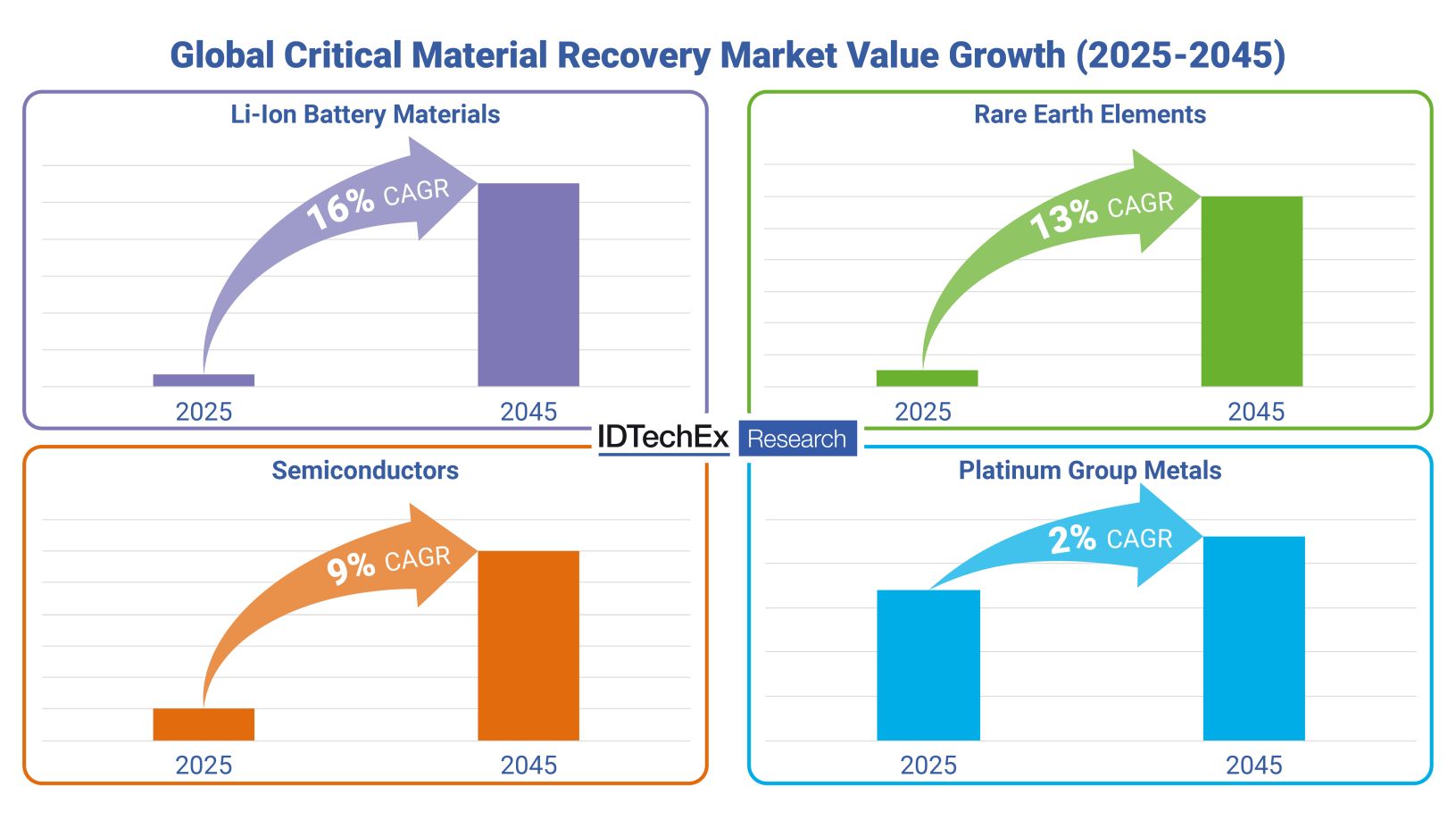

From electric vehicles and wind turbines to chips for AI and computing, most emerging technologies share a reliance on critical semiconductor, battery metal, and rare earth element materials. As demand continues to grow and supply risks swell, a market for critical material recovery technology that enables recycling from end-of-life products and waste is rapidly emerging. IDTechEx's report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players“, analyzes recycling technologies, key players, and the value chains emerging to address rising critical material demand.

Europe is set to expand its critical material recovery capacity, investing in recycling technologies to shore up strategic raw material supply. In March 2025, the EU Commission announced that it would be funding 47 strategic raw materials projects across Europe. Ten critical material recycling projects were announced, focusing on the recovery of battery-grade lithium, nickel, cobalt, graphite, and manganese, as well as rare earth elements for magnet applications. The projects play an important role as the region aims to meet its ambitious recycling target that 25% of the EU's demand of strategic raw materials is met by recycling by 2030.

The development of domestic critical material recovery technology in Europe has emerged out of necessity. Since 2024, China has increasingly imposed global export restrictions on critical raw materials. In December 2024, antimony, gallium, and germanium mineral exports were banned to the US, following earlier restrictions set on antimony-related products. In early 2025, additional export controls were placed on tungsten, tellurium, bismuth, molybdenum, and indium, essential materials used in defense and industrial applications. The tellurium export restrictions announced have the potential to disrupt CdTe thin film photovoltaic markets, with approximately 30-40% of global tellurium production occurring in China in 2024.

Despite facing longstanding export restrictions, extraction and separation technologies used to recover critical rare earth elements from magnets are beginning to emerge in Europe. The Caremag project in France will be capable of processing up to 2,000 tonnes of rare earth magnets annually by 2027 using a proprietary hydrometallurgical and solvent extraction technology. Meanwhile, HyProMag is scaling up its short loop hydrogen processing technology in Germany, which it hopes may process up to 500 tonnes of sintered magnets at full capacity. IDTechEx forecasts that over 10,000 tonnes of rare earth elements will be recovered from end-of-life products and waste annually by 2040 through a combination of long- and short-loop recycling processes. More information and full analysis of critical rare earth element recovery technologies can be found in IDTechEx's latest report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players”.

The ramp up of lithium-ion battery recycling will likely define whether Europe achieves its 25% strategic raw material recycling target by 2030. In 2025, the total annual battery recycling capacity in Europe reached 145 kilotonnes. Battery recycling capacity is set to expand as an increasing number of electric vehicles approach end-of-life. IDTechEx expects that hydrometallurgical recycling capacity will grow faster than pyrometallurgical due to its lower energy requirements and ability to more easily recover battery grade materials and salts. While end-of-life electric vehicles will supply a growing volume of batteries for recycling over the next decade, manufacturing scrap will likely continue to dominate feedstock streams in the short term. IDTechEx forecasts the Li-ion battery recycling market to reach US$52B in value by 2045.

Source: IDTechEx

There is reason to be optimistic that recycling may address critical material demand in Europe, with established germanium and platinum group metal recovery representing notable success stories. Platinum group metals, such as palladium, platinum, and iridium, are routinely recycled from spent catalysts, with high metal value – exceeding US$10,000s per kilogram – a major driver. Germanium recycling from optical glasses contributes approximately 20% of global production annually. In this case, germanium use is largely consolidated in optoelectronics applications, simplifying waste separation during pre-processing and enhancing recovery rate. While consolidated application demand is important, recoverable value will be the most crucial factor in dictating the economics of recycling in emerging critical material recovery streams.

Critical material recovery in Europe isn't a question of if but when. Critical raw material recycling projects are expanding at pace, with 10,000s of tonnes of additional Li-ion battery metal and rare earth element recovery capacity to become operational by 2030. The final piece to the European critical material security puzzle will be marrying the anticipated volume of end-of-life products and waste with effective collection and separation processes to recycle critical materials economically.

The IDTechEx report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players“, evaluates critical material recycling technologies, highlighting key players and market outlooks for lithium ion battery recycling, rare earth element, semiconductor material, and platinum group metal recovery technologies.

For more information on regulations, technologies, key players, economics, and granular recycling and second-life EV battery market forecasts, please refer to IDTechEx's market reports on Li-ion Battery Recycling and Second-life Electric Vehicle Batteries.

For the full portfolio of market research available from IDTechEx, please see www.IDTechEx.com. Downloadable sample pages are available for all IDTechEx reports.